Comprehensive Guide on https:// finanzasdomesticas.com/china-prohibe-las-criptomonedas/

Introduction

China’s recent ban on cryptocurrencies has sent shockwaves through the global financial markets. As one of the largest economies in the world, China’s decision to prohibit the use and trading of digital currencies like Bitcoin is significant. This article delves deeply into the reasons behind China’s ban, its implications for the global economy, and what it means for cryptocurrency enthusiasts and investors.

The news that China is banning cryptocurrencies is not surprising given its restrictive economic policies. However, it’s notable that, despite being a growing economy, China has now prohibited business transactions involving Bitcoin and other digital currencies.

1. Overview of China’s Cryptocurrency Ban

The ban on cryptocurrencies by China, detailed in sources like Finanzas Domesticas, marks a pivotal moment in the digital currency world. This decision aligns with China’s broader economic and regulatory policies, aimed at maintaining financial stability and control over its economic activities.

1.1 What is the Ban?

China has officially prohibited all cryptocurrency trading and transactions. This includes a ban on Bitcoin mining and the use of digital currencies for investment purposes. The move reflects China’s long-standing skepticism towards cryptocurrencies and its preference for maintaining control over its financial system.

1.2 Historical Context

China’s relationship with cryptocurrencies has been turbulent. The country initially embraced blockchain technology but quickly moved to restrict cryptocurrency activities. Past crackdowns on crypto exchanges and initial coin offerings (ICOs) set the stage for this comprehensive ban.

2. Reasons Behind the Ban

Understanding why China has taken such drastic measures requires a look at several key factors:

2.1 Financial Stability Concerns

China’s government has expressed concerns that cryptocurrencies could pose risks to financial stability. The high volatility of digital currencies and the potential for speculative bubbles are seen as threats to the country’s economic health.

2.2 Regulatory Control

Cryptocurrencies operate independently of traditional financial systems, which undermines the Chinese government’s ability to regulate and control economic activities. By banning cryptocurrencies, China aims to preserve its financial sovereignty and regulatory control.

2.3 Environmental Impact

Bitcoin mining and other cryptocurrency activities consume significant amounts of energy. China’s emphasis on reducing carbon emissions and combating climate change aligns with the decision to ban activities that are seen as environmentally damaging.

3. Implications for the Global Economy

China’s cryptocurrency ban has far-reaching consequences beyond its borders:

3.1 Impact on Cryptocurrency Markets

The ban has led to a decline in cryptocurrency prices globally. Investors are wary of the potential for similar actions from other countries, leading to increased volatility in digital asset markets.

3.2 Shift in Mining Operations

With China being a major hub for cryptocurrency mining, the ban has forced miners to relocate to other countries. This shift could lead to changes in the distribution of mining power and influence in the cryptocurrency space.

3.3 Regulatory Ripple Effects

China’s move may prompt other nations to consider stricter regulations on cryptocurrencies. Governments around the world will be closely monitoring the impact of China’s ban and could potentially adopt similar measures.

4. The Future of Cryptocurrencies

Despite China’s ban, the future of cryptocurrencies remains dynamic:

4.1 Innovation and Adaptation

Cryptocurrencies and blockchain technology continue to evolve. New innovations and adaptations are likely to emerge, addressing some of the concerns that led to the ban.

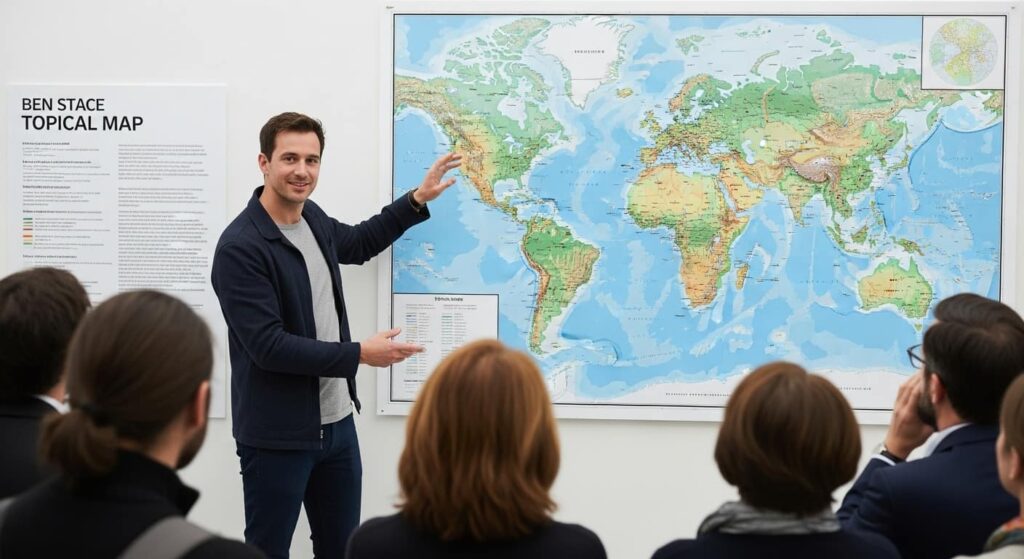

4.2 Regional Variations

Different countries have varying attitudes towards cryptocurrencies. While China has taken a restrictive approach, other nations are embracing digital currencies and exploring their potential benefits.

4.3 Market Recovery

The cryptocurrency market has experienced downturns in the past and has shown resilience. As the market adjusts to the new regulatory environment, there may be opportunities for recovery and growth.

5. FAQs

5.1 What does the ban mean for cryptocurrency investors in China?

Investors in China are prohibited from trading or using cryptocurrencies. They may face legal consequences if they attempt to bypass the ban. However, many are looking for ways to protect their investments or move assets abroad.

5.2 How does this ban affect global cryptocurrency markets?

The ban has led to increased market volatility and a drop in prices. It has also caused shifts in mining operations and could influence regulatory approaches in other countries.

5.3 Are there any countries following China’s lead?

Several countries have implemented or are considering regulations similar to China’s ban. However, many others continue to support and regulate cryptocurrencies in varying ways.

5.4 What steps are being taken to address environmental concerns related to cryptocurrencies?

Efforts are underway to develop more energy-efficient mining technologies and to promote the use of renewable energy sources in cryptocurrency operations.

Conclusion

China’s cryptocurrency ban is a landmark event in the world of digital finance. While the immediate effects are significant, the long-term implications will continue to unfold as the global community adapts to these changes. The cryptocurrency market’s resilience and innovation will play crucial roles in shaping its future in a rapidly evolving landscape.

English

English